Financial reports must be submitted annually, therefore, there is no room for errors when it comes to bookkeeping. Ideally we recommend taking a AAT Bookkeeping Course from Training Link. The form of the report introduced will be based on the size of the club and the quantity of its actions. If a team has a couple of members, and of which all transactions are for money, a statement of receipts and payments will be adequate, but in the event of a huge club an income and expenditure statement in addition to a balance sheet are desired.

The dimensions of the club and the volume of its transactions will also determine in a complete set of books, that will decide if they have to be kept or not. If the business is small and deals with money transactions only it’ll be enough to enter all trades in an investigation cash book or in different cash receipts and cash payments journal and prepare a statement of receipts and payments out of it. In a bigger club complete ledger accounts will be opened, a cash receipts Journal, a Cash Payments Journal and a General Journal will usually be used. It’s very important that a comprehensive list of members will be held on and will be listed that membership fees are paid.

The dimensions of the club and the volume of its transactions will also determine in a complete set of books, that will decide if they have to be kept or not. If the business is small and deals with money transactions only it’ll be enough to enter all trades in an investigation cash book or in different cash receipts and cash payments journal and prepare a statement of receipts and payments out of it. In a bigger club complete ledger accounts will be opened, a cash receipts Journal, a Cash Payments Journal and a General Journal will usually be used. It’s very important that a comprehensive list of members will be held on and will be listed that membership fees are paid.

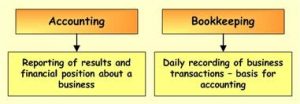

Accounting Procedures

- The amounts deposited must correspond with the receipts issued. For payments the essential purchase vouchers must be filed and each payment ought to be authorised by two persons. If a current account is retained, two people usually the secretary and the chairman, keep track. When a savings account is kept as is frequently the case, the withdrawal slip must be signed by two authorised persons.

- The documents the trades are entered in the right journals. Occasionally a petty Cash Journal can be utilized. As the trades of a club are usually not so voluminous the journals are shut off annually at the close of the accounting period.

- The journals posting is completed to the ledger, accounts are cast and pen footings written in. A trial balance is extracted to check the posting and arithmetical correctness of the job. At the close of the accounting period that the essential journal entries are created for the alterations and posted.

- The final journal entries are created and published, in the case of clubs, submitting is completed to an income and expenditure account in which the excess or deficit is calculated and published. Income and expenditure account are shut off to the accumulated fund accounts rather than the capital account. A post-closing trial balance is expressed.

Based on how big the club and the amount of trade, the aforementioned processes are usually departed from, as short cuts can be followed to achieve the final outcome. Rather than working according to a comprehensive method of bookkeeping with the ledger accounts as described in the paragraph on accounting processes, clubs frequently compose just Cash Receipts and Payments Journals or an investigation cash book and prepare the financial statements for the members from the information found in them. To begin with it is essential to note how an investigation cashbook is accommodated for recording the transactions of businesses. In evaluation cash book the bank account is stored in the cash book itself. Suitable analysis columns are utilized to input the various receipts and expenses and the total of each column is found. The money book is then closed off just at the end of the year, by the Cash Reserve a summary of the receipts and payments could be made for the year.

For more information on how to learn bookkeeping for your business please visit the Training Link website